How to Choose the Right Medical Insurance Plan: Tips and Best Practices?

Choosing the health insurance best plan is no small task. With an overwhelming variety of options in the market, from comprehensive medical insurance plans to specialised critical illness insurance, it can be confusing to determine which one fits your needs. However, making the right choice is essential to safeguard your financial well-being and ensure access to quality healthcare when needed.

Understand Your Healthcare Needs

Before diving into the ocean of available medical insurance plans, evaluate your health requirements. Are you looking for coverage for routine medical expenses or something that includes critical illnesses like cancer, heart disease, or stroke? Your age, lifestyle, family medical history, and specific healthcare needs are vital in determining the right policy. For instance, if your family has a history of chronic illnesses, investing in a plan with a critical illness insurance rider might be a wise move.

Assess the Coverage Offered

Not all medical insurance plans are created equal. Comprehensive coverage should ideally include in-patient hospitalisation, pre- and post-hospitalisation expenses, diagnostic tests, ambulance charges, and even day-care procedures. Check if the plan extends to include critical illnesses, maternity benefits, or coverage for alternative treatments like AYUSH. If you’re considering health insurance best plans, compare the scope of coverage to ensure you get the most value for your money.

Check for a Wide Network of Hospitals

A good medical insurance plan provides cashless hospitalisation facilities in a broad network of hospitals. This ensures you’re not left scrambling for funds during a medical emergency. Look for plans that have a significant presence in your city or region. Additionally, consider hospitals where you and your family will likely seek treatment, and ensure they’re part of the insurer’s network.

Evaluate the Premium and Affordability

While it’s tempting to go for a plan with a lower premium, it’s equally important to balance affordability with adequate coverage. A cheaper plan might have higher co-payments or limited coverage. Use online calculators to compare premium amounts across multiple insurers and opt for a plan that offers the best affordability and benefits. Remember, medical emergencies are unpredictable, and skimping on coverage now might result in higher out-of-pocket costs later.

Look at Critical Illness Coverage

With the rising incidence of life-threatening diseases, adding a critical illness insurance rider to your medical insurance plan is becoming increasingly popular. This coverage offers a lump sum benefit upon diagnosis of specified illnesses like cancer, kidney failure, or major organ transplants. Such a benefit can help cover non-medical expenses, loss of income, or specialised treatments that traditional health insurance may not.

Review the Waiting Periods

Waiting periods are an often overlooked aspect of medical insurance plans. These are durations during which specific claims, like pre-existing conditions or maternity benefits, are not covered. For most plans, the waiting period ranges from two to four years. If you have a pre-existing condition, opt for a plan with a shorter waiting period. This ensures you’re not caught off guard when you need coverage the most.

Assess Claim Settlement Ratio (CSR)

The best health insurance plan should offer comprehensive coverage and ensure a smooth claims process. The Claim Settlement Ratio (CSR) indicates the percentage of claims the insurer settles out of the total claims received. A higher CSR signifies a reliable insurer. For example, insurers with a CSR of 90% or above are generally more trustworthy.

Look for Additional Benefits and Riders

Many insurance providers offer riders that enhance the scope of your policy. Common riders include personal accident cover, top-up plans for high-value claims, and critical illness riders. These additions may come at a slightly higher premium but provide comprehensive protection. If you plan to invest in critical illness insurance, confirm the list of diseases covered and any exclusions.

Compare Plans Online

Thanks to technology, comparing medical insurance plans is easier than ever. Use online aggregators to evaluate policies side-by-side. Pay attention to coverage, premium costs, exclusions, and additional benefits. These platforms often provide reviews and ratings, which can give you insights into the user experience and the insurer’s credibility.

Read the Fine Print

Insurance policies often come with terms and conditions that can impact your coverage. For example, some policies may have a cap on room rent or restrict coverage to specific types of treatments. Deductibles, co-payments, and sub-limits can significantly affect your out-of-pocket expenses. Always go through the policy document in detail to understand what is and isn’t covered.

Check for Lifetime Renewability

Medical needs don’t diminish with age, so choosing a plan with lifetime renewability is crucial. Some plans might have an age limit for renewal, leaving you without coverage when you need it most. A policy with lifetime renewability ensures continued coverage, offering peace of mind as you age.

Evaluate Tax Benefits

One of the lesser-discussed perks of medical insurance plans is the tax benefit under Section 80D of the Income Tax Act. Premiums paid for health insurance can be deducted from your taxable income, reducing your tax liability. This limit is even higher for senior citizens, making it a win-win proposition.

Conclusion

Selecting the health insurance best plan requires careful thought and research. A well-chosen policy protects you financially during medical emergencies and provides peace of mind for you and your family. You can make an informed decision by understanding your needs, evaluating the coverage, and considering critical illness add-ons. Don’t rush, compare multiple plans, read the fine print, and choose a policy that offers comprehensive coverage and affordability. Remember, a good health insurance plan from leading brands like Niva Bupa is an investment in your future health and financial security.

Navigating Health Insurance – How Some Plans May Cover Treatment at Pain Clinics

Navigating Health Insurance – How Some Plans May Cover Treatment at Pain Clinics  Navigating the Globe with Confidence: The Complete Travel Guide for Type 1 Diabetes

Navigating the Globe with Confidence: The Complete Travel Guide for Type 1 Diabetes  How Anti Aging Clinics Personalize Treatment Plans for Different Skin Types

How Anti Aging Clinics Personalize Treatment Plans for Different Skin Types  Discover the Best TRT Clinic in Boston: Your Guide to Quality Hormone Care

Discover the Best TRT Clinic in Boston: Your Guide to Quality Hormone Care  Dental Infection Treatment and the Evolution of Advanced Dental Technology

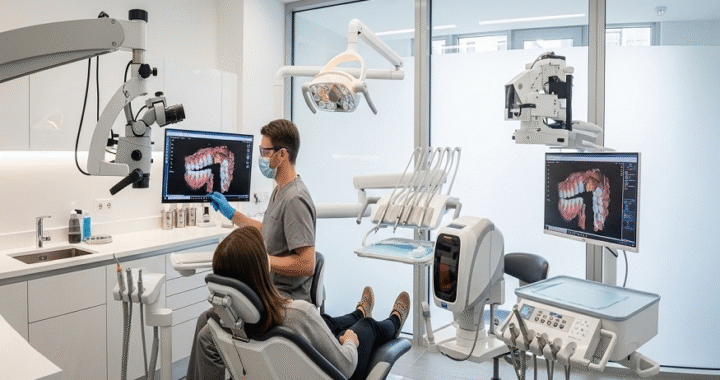

Dental Infection Treatment and the Evolution of Advanced Dental Technology